|

|

|

|

|

|

||

Nassim Nicholas Taleb, The Black Swan (2007)

Taleb (pictured right) is a professor in New York and writer. This best-seller has been hugely influential in explaining unexpected events like:

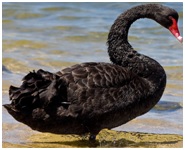

Book summary What is a Black Swan? A Black Swan is an event that

Why is it called a Black Swan? Because people thought that all swans were white until black ones were unexpectedly discovered in Australia.

Other examples of Black Swans...

Why are Black Swans becoming more likely? The future is increasingly unpredictable . So any organization must have a plan to deal with Black Swans.

Why do we ignore Black Swans? Because we:

How to identify opportunities from Black Swans (called positive Black Swans, which we should aim for) 1. Imagining the impossible and totally unpredictable (for example a revolutionary product like Google that far exceeds customer expectations). Accept that the past bears no relation to the future.

2. Avoiding simplifying and categorizing things Accept the world is:

Black Swans make inappropriate... ...ideal and well defined concepts like rules and forecasting models (derived from Plato’s philosophy, or “Platonicity”).

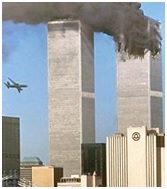

3. Accepting that what you don’t know is far more important than what you know Before 9/11 the knowledge that New York was

an easy terrorist target didn’t stop it happening. Learn from:

Don’t be surprised when they happen.

4. Thinking about general significant ideas not specific, unimportant facts

5. Challenging conventional wisdom (existing knowledge and ideas)

6. Focusing on the rare, volatile and extraordinary, not the normal, stable and ordinary Imposing order on volatility (like restricting people’s freedom as in the Middle East) can lead to even

greater volatility and chaos. Accept the world of unpredictable extremes (Extremistan) not just the Mediocristan world of:

Three other tips 1. Don’t think you’re in control when you’re not (the illusion of control).

2. Don’t think that doing something is always better than doing nothing (the action bias) Attempted reforms can have harmful, unintended consequences because of the imperfections of human nature. 3. Avoid oversimplified story telling (the narrative fallacy) This describes the world as:

Tips for personal and business success 1. Aggressively pursue the opportunities of positive Black Swans (which often come from luck, so seize your lucky breaks!) Remember you are a Black Swan, because you are extraordinarily lucky to be alive!

2. Don’t be dictated to by other people and external events

3. Focus on your aims Don’t be distracted or misled by:

4. Be creative

Our world is dominated by the extreme, the unknown, and the very improbable. This is a book about uncertainty; to this author, the rare event equals uncertainty

|

|

|

||

|

|

||

| Copyright © wisdomtowin.com 2025 All Rights Reserved | ||

|